Mortgage Market Update – September 2023 Review

As ever, September proved to be another action-packed month.

True to form for a British Summer, as soon as the kids go back to school, the sun comes out… We also had a pleasant surprise with the Base Rate staying at 5.25% when most had expected a rise. Blowing my own trumpet, I was quoted in The Guardian just prior to the announcement, as due to the surprise fall in inflation that opened the door to a hold, which turned out to be the case.

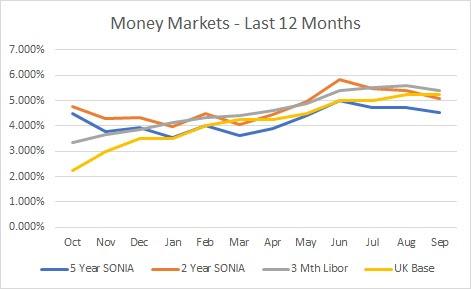

September also saw the 1st Anniversary of the now infamous mini-budget, the ripples of which we are still feeling now, and in part, makes up much of the context of this email. The money market graph below doesn’t really give you the full picture, as if you went back to August ’22 the expectation was that the base rate would get to just over 3% but within a week the expectation was then north of 5%! Hence all the turbulence that ensued (and the not really discussed enough aspect that we very nearly all lost our pensions in the process…). However, as we adjust to life with higher-than-expected interest rates largely as a result of the mini-budget, it is very timely to see where that leaves us with mortgage pricing and the best way to navigate the current market:

When Is The Right Time To Fix?

It has made a lot of press in recent weeks that lenders are cutting their fixed rate products, which is great to see. This is fuelled by the already mentioned fall in inflation and to be blunt, very quiet mortgage market. So lenders are having to cut rates to win new borrowers. As I say directly in this FT Article, I still feel there is scope for them to come down more. So that poses the question – when is the right time to fix?

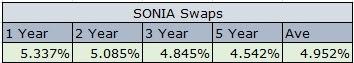

To expand my thought path in more detail, I have put some info below on current money markets. As Fixed Rates are largely funded by SONIA (Sterling Over Night Interest Average – basically the rate at which banks lend to one another over the relevant time period), this is the best place to look and base our opinion on:

Based on the above info, I still will not be advising going for a fixed rate just yet, unless it is specifically important to a client to do so (as your preferences always trump all this conjecture!). As you’ll see in the ‘Best Mortgage Rate’ section below, fixed rates are coming down quickly and are well under the Base Rate currently, so on face value that may look like a good option to fix now? Why I have pulled out the market info above is that you have to look at the trend to get a clearer picture. Money Markets are all coming down (also see graph further down the email), we are expecting rates to fall in the coming years, and only the very best rates on the market are below the 5 year average above. The majority of people will still be offered a 5-year fixed rate above 4.95% due to the deposit required/your specific circumstances, so we are currently recommending people hold fire, sit tight on a penalty free tracker and keep your powder dry to swap into a fixed rate at the optimum time. Hence why Trackers are now over half of the mortgages we arranged last month. We are watching this closely, and my opinion could change quickly, so more on this as it happens.

I have always believed in strong partnerships in business. Indeed I used the word in the name of the company, so I am very proud to announce we are sponsoring AFC Wimbledon for the current season. If anyone knows the history of the club, it is a very special indeed, and one of the very few fan-owned professional sports clubs in the country. You can read more about that here but the point is, we now have access to the ground for games and events.

The club is based in our heartland of South West London, where the majority of our clients are based or at one time lived. So if you, colleagues or your company would like to attend a game or use the venue, please do get in contact and we would love to help you with that. Also, keep an eye on our social feeds over the course of the season as there will be various giveaways.

We also have a number of new partnerships in the pipeline so more on that in due course.

Money Market Rates:

5 Year money down by 0.164% to 4.542%

2 Year money down by 0.304% to 5.085%

3 Month Sterling Libor down 0.188% to 5.409%

UK Base Rate held at 5.25%

Source: chathamfinancial.com & globalmarketrates.com

Market Leading Mortgage Rates:

2 Year Fixed Rates from 5.36% (previously 5.66%)

5 Year Fixed Rates from 4.82% (previously 5.17%)

10 Year Fixed Rates from 4.94% (previously 4.94%)

Variable Rates from 5.29% (previously 5.29%)

Buy To Let Rates from 4.19% (previously 4.64%)

Source: Twenty7Tec – Oct 2023 – The actual rate you will be offered will be dependent on your personal circumstance and deposit level. Please speak to one of our advisers so that they can guide you through this process

Summary

Now more than ever, quality financial advice is needed. Not just to navigate the product options discussed above, but also the very tricky ‘affordability’ rules that lenders are imposing. This is how lenders determine how much they will lend you, which sways hugely on your income, outgoings, debts, commitments and spending patterns. Not all lenders look at things the same way, so that is why it is imperative you talk to an adviser who can find the best way forward for you.

So, if you do not currently work with us, we would love to talk to you and get you on the way to getting your mortgage paid off as soon as possible! We are acutely aware that no-one actually wants a mortgage, but you want what it achieves, so let’s help you on that journey as best as we can.