Mortgage Market Update – October 2023 Review

Founder of Rose Capital Partners

While trying to resist all the Halloween puns I can, it was fair to say that October was a scary month if you were looking for positive economic data!

That was acutely felt in the mortgage/property world as we have seen extremely low levels of purchase and remortgage activity. That is not surprising when you look at the context of the market which is – falling house prices and falling mortgage rates – a recipe for inertia.

So the golden question is – how much longer will this continue?

If we look specifically at mortgage products, we saw quite big falls in the headline rates being offered through October (please see below market data for an update on that), but these seem to have tailed off now. That was largely fuelled by inflation staying at 6.7% when a fall was predicted. That had the kneejerk reaction of some to say the Bank of England would increase rates next week, when more level-headed commentators (and a view I agree with) feel that a longer period of rates being held at 5.25% is now likely. As inflation is the main driver of where the Bank of England peg their headline rate, this will be one to watch on a month by month basis, but it has led to most lenders stopping cutting rates for the time being.

As we have advised for some time, it may well be the best idea to stay on a penalty free tracker where that is suitable. Indeed our internal stats back up that is a winner with our clients at present (see below). With the Base Rate not predicted to go back to 4.5% for another 5 years, the pricing of the current fixed rates looks about right, so it is a very tough call to stick or twist on a Tracker at present. If rates do fall next year as predicted, you could win. If inflation falls more steeply and rates fall faster, you could win. If something unexpected happens you also have the flexibility to change products, so that could also be a win. Hence why flexibility is key right now until the future looks a bit clearer. The Bank of England meeting on Thursday, and more importantly their comments and voting around the decision, will be a key indicator of where we may see mortgage rates head in the coming months.

There is also a growing trend of borrowers sticking with their current lender. It may be harder to switch, or people simply do not want the hassle, but now more than ever, expert advice is needed as outlined above. Brokers do at least get the same rates as if you were to go to a lender directly, if not cheaper. So if you are in this situation, please do reach out to us as the landscape isn’t very clear on what is the best product to take and it is often down to your own personal preferences as to what is best. We are always happy to talk all things mortgages to you!

Partnerships

As mentioned in our last update, we have a number of exciting new partnerships, plus some old ones, where we can help you on even more things finance/business related. Seeing as Partners is in our very name, it is our ethos that where we can’t help directly, we want to be able to refer you to the best companies in the relevant areas. Below is a breakdown of the types of situations we help with. If this is of interest to you, simply reply to this email and we will connect you where needed, or speak to your advisor who will be happy to do the same:

- Pensions and Investments

We have just linked up with one of the best IFA’s in the country who will only be too happy to help on all things Investment related. We also have a more bespoke offering if you have large sums you wish to invest. - Equity Release

While we can help for the vast majority of mortgages, we do not arrange Equity Release/Lifetime mortgages for the over 55’s, where the loan is repaid on sale of the property (where monthly payments are made, we can help as usual). So if you are looking to release funds from your home, or help a family member onto the property ladder, please let us know so we can direct you to the best person to speak too - Corporate/Asset Finance

If you are lucky enough to be purchasing a Yacht, Plane, Classic car or large property abroad, we have the perfect partner for you. Equally, if you own a business or have a controlling function in one, and looking to raise funds, this will also be the right company to be talking to - Legal Work

We have a wide range of partnerships that can help you if you are looking to move, right up to complex company work. So again, should you ever need assistance with anything in the legal arena, please let us know and we’ll connect you to the relevant firm - Accounting

We have a long standing relationship with the Accountants that we use, who again, will offer very competitive terms if referred by us, so if you need this service, or looking to switch providers, please do let us know - Outsourced HR Function

We have recently started working with an outsourced HR Team who are willing to offer a discount on their services if referred to them by us. So if this is of use to your firm, please do let us know - AFC Wimbledon

Lastly, we have a great partnership with AFC Wimbledon where many of our clients have already been to watch games, hire boxes and generally enjoy their hospitality. It is a great family club in the heart of SW London, with a unique history, so if you want to get down to Plough Lane (SW19), just let us know!

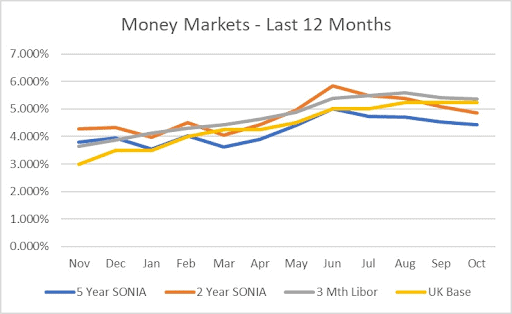

Money Market Rates:

- 5 Year money down by 0.115% to 4.427%

- 2 Year money down by 0.225% to 4.866%

- 3 Month Sterling Libor down 0.035% to 5.374%

- UK Base Rate held at 5.25% (no meeting in October)

Source: chathamfinancial.com & globalmarketrates.com

Market Leading Mortgage Rates:

- 2 Year Fixed Rates from 4.90% (previously 5.36%)

- 5 Year Fixed Rates from 4.64% (previously 4.82%)

- 10 Year Fixed Rates from 4.94% (previously 4.94%)

- Variable Rates from 5.38% (previously 5.29%)

- Buy To Let Rates from 4.09% (previously 4.19%)

Source: Twenty7Tec – Oct 2023 – The actual rate you will be offered will be dependent on your personal circumstance and deposit level. Please speak to one of our advisers so that they can guide you through this process

Summary

Now more than ever, quality financial advice is needed. Not just to navigate the product options discussed above, but also the very tricky ‘affordability’ rules that lenders are imposing. This is how lenders determine how much they will lend you, which sways hugely on your income, outgoings, debts, commitments and spending patterns. Not all lenders look at things the same way, so that is why it is imperative you talk to an adviser who can find the best way forward for you.

So, if you do not currently work with us, we would love to talk to you and get you on the way to getting your mortgage paid off as soon as possible! We are acutely aware that no-one actually wants a mortgage, but you want what it achieves, so let’s help you on that journey as best as we can.

While it is great that we can help you on the finances of your home, it is equally important that we protect the debt we create, yourself and your family.

Our Resident Protection expert Simon Williams is on hand to help. In this video he explains the key things to consider.

Please do contact Simon and he can talk over your specific needs, plus the Free Will that we offer all our clients. You can book directly into his diary here.