Mortgage Market Update – August 2023 Review

Founder of Rose Capital Partners

As a rather damp summer draws to a close and (thank the lord) schools are back in shortly, we can once again focus on the hamster wheel of work, school runs and having a mad scramble to hit your goals for the year! That is all before the dreaded C word starts to get mentioned…

True to form, the last month has been a very odd time in the mortgage and property world, so here is my attempt at making sense of the main themes that may affect you which are – what is going in with mortgage rates and house prices?

On that note, I have started doing very short explainer videos on our YouTube channel. I would be very interested to hear if you feel these are worthwhile, and/or what topics you would like discussed or explained? Just reply to this email with any comments as we would love to hear from you.

How can Rates be going up and down?

This is the biggest mixed message in the market right now, in that the Bank of England raised rates in August (to 5.25%) and are very likely to raise them again in September (to 5.5%) but yet mortgage rates are coming down? How can that be?

It is important to look at what you are referring to in terms of ‘rates’. The Bank of England Base rate itself is only a benchmark and will only affect you if you are specifically on a Tracker mortgage (which is around 26% of borrowers at present), which have gone up. However, Fixed Rate mortgages are falling, and will most likely keep falling well into the Autumn and perhaps new year. The reason is that Fixed Rate mortgages are priced on the expectation of what will happen over the next 2-5 years. In the last few months, the expectation is that the Bank of England will not go as high as expected and may even cut rates faster from 2024 onwards. Therefore, lenders are re-pricing these products lower on that new expectation. Hence, how Trackers can go up, and Fixed Rates down at the same time.

This has led to a game of chicken for many people coming off an existing mortgage deal or arranging a new purchase – do you gamble on a Tracker rate now with no exit penalties with an eye to switch onto a lower Fixed Rate in the new year? Or do you take the safe option and fix now? And if you do go Tracker how long do you wait?

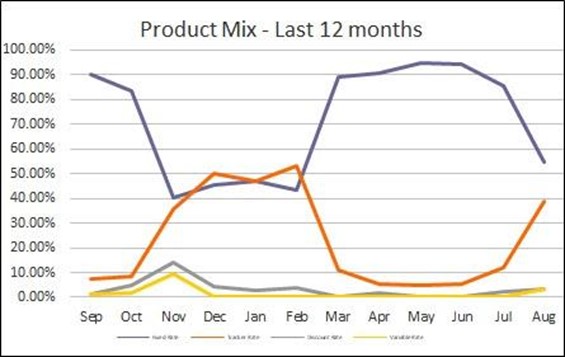

Interestingly we have seen a huge spike in Tracker mortgages being taken out (see below graph) with nearly half of our new mortgages in August being on a Variable rates. As I said in my last update – fortune favours the brave, and I suspect those who do hold their nerve until the new year will be rewarded for doing so. We are tracking this very closely so watch this space.

One of our national pass times is the obsession around house prices, and our seemingly endless will for them to keep rising. As I have said many times before I feel this is very unhealthy as if prices do keep rising, homeownership will be out of the grasp of the majority of people if it isn’t already. In fact we rank very low globally for the percentage of homeowners.

That said, we do seem to be in a window of soft/falling prices, but as always, the lack of supply of property will stop house prices falling too low from where they are now. Also, it is important to think about what time frame are you looking at? Figures suggest house prices are down around 2.4% in the last 12 months (Halifax) but if you were to look over the last 3 years house prices are up around 18% (Halifax again) due to the post Covid bounce (and up 2512% in the last 50 years! If you don’t believe me, please do check).

As I have said many times before, and suspect I’ll say again – the only way I think house prices will come down significantly will be if the Govt starts building affordable homes at scale, or banks stop lending as they did in 2008. Until one or both those things happen, you will get the odd lull like now, but that is just a good time to buy as no doubt house prices will kick on next year and beyond unless something major happens.

AFC Wimbledon Partnership

I have always believed in strong partnerships in business. Indeed I used the word in the name of the company, so I am very proud to announce we are sponsoring AFC Wimbledon for the current season. If anyone knows the history of the club, it is a very special indeed, and one of the very few fan-owned professional sports clubs in the country. You can read more about that here but the point is, we now have access to the ground for games and events.

The club is based in our heartland of South West London, where the majority of our clients are based or at one time lived. So if you, colleagues or your company would like to attend a game or use the venue, please do get in contact and we would love to help you with that. Also, keep an eye on our social feeds over the course of the season as there will be various giveaways.

We also have a number of new partnerships in the pipeline so more on that in due course.

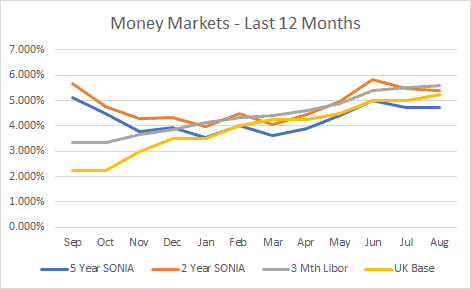

Money Market Rates:

- 5 Year money down by 0.032% to 4.706%

- 2 Year money down by 0.104% to 5.389%

- 3 Month Sterling Libor up 0.099% to 5.597%

- UK Base Rate up by 0.25% to 5.25%

Source: chathamfinancial.com & globalmarketrates.com

Market Leading Mortgage Rates:

- 2 Year Fixed Rates from 5.66% (previously 5.79%)

- 5 Year Fixed Rates from 5.17% (previously 5.25%)

- 10 Year Fixed Rates from 5.04% (previously 4.94%)

- Variable Rates from 5.29% (previously 5.04%)

- Buy To Let Rates from 4.64% (previously 4.39%)

Source: Twenty7Tec – Aug 2023 – The actual rate you will be offered will be dependent on your personal circumstance and deposit level. Please speak to one of our advisers so that they can guide you through this process

Summary

Now more than ever, quality financial advice is needed. Not just to navigate the product options discussed above, but also the very tricky ‘affordability’ rules that lenders are imposing. This is how lenders determine how much they will lend you, which sways hugely on your income, outgoings, debts, commitments and spending patterns. Not all lenders look at things the same way, so that is why it is imperative you talk to an adviser who can find the best way forward for you.

So, if you do not currently work with us, we would love to talk to you and get you on the way to getting your mortgage paid off as soon as possible! We are acutely aware that no-one actually wants a mortgage, but you want what it achieves, so let’s help you on that journey as best as we can.